R.O.L.L Call#18

Tesla, Trump, SPACs and more...

Reading

Tesla’s 2024 Outlook

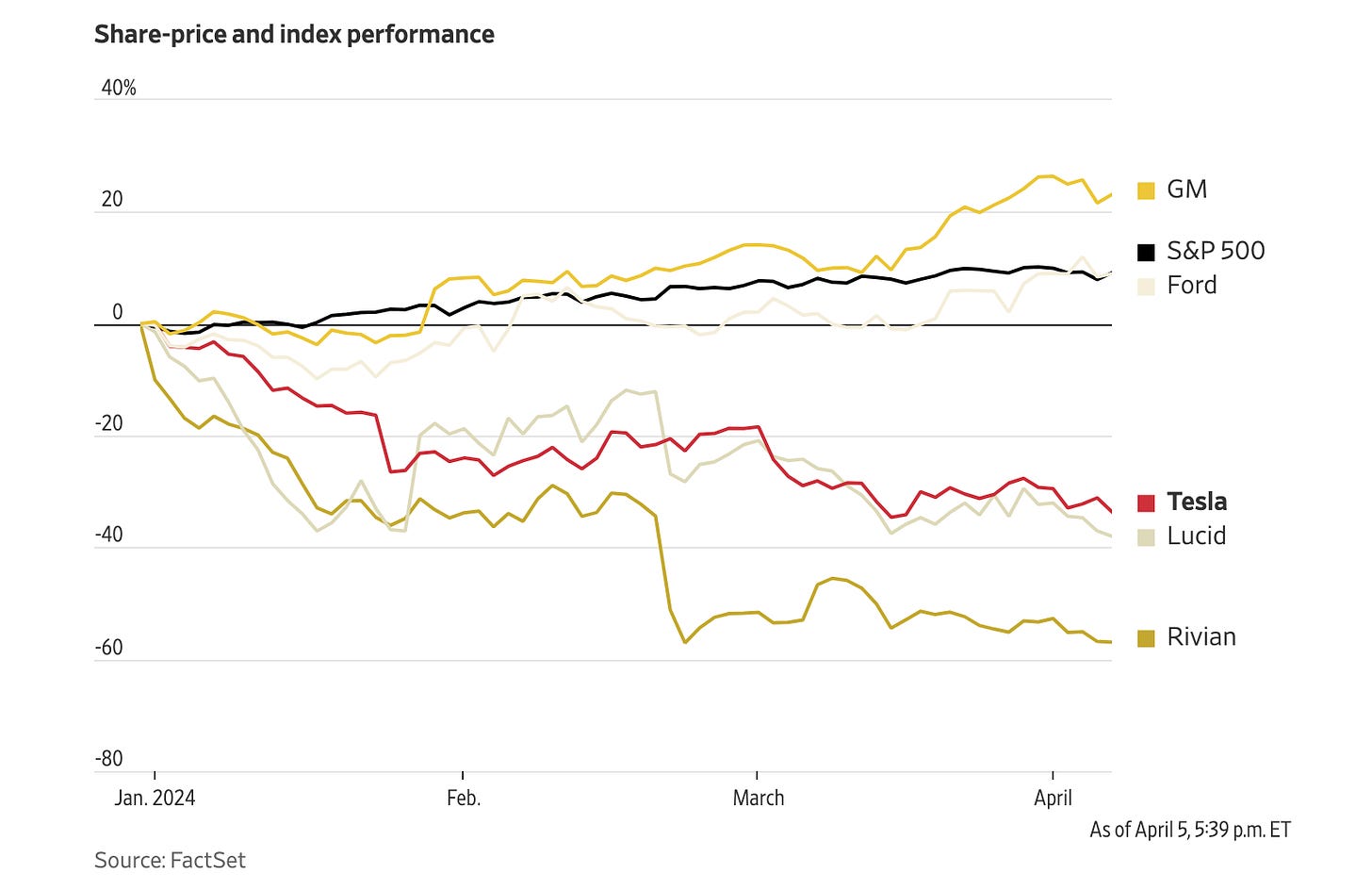

Tesla is facing significant challenges despite being a pioneer in the electric vehicle (EV) industry. Sales have declined, margins are shrinking, and the stock value has plummeted. Although Tesla remains the most valuable automaker globally, with a market capitalization that once surpassed $1.2 trillion, its value has plummeted by more than half since its peak in 2021.1

One of the primary challenges facing Tesla is the cooling consumer interest in electric vehicles. Despite being a pioneer in the EV market, Tesla's lineup is now perceived as outdated, prompting the company to resort to price cuts to stimulate demand. However, these measures have raised doubts about Tesla's long-term profitability and ability to maintain its competitive edge.

Elon Musk's attention has also been diverted by his involvement in other ventures, such as his acquisition of Twitter and pursuit of artificial intelligence projects. Musk's public persona, marked by controversial statements and confrontations on social media, has alienated some potential Tesla buyers and added to the company's challenges.

Tesla has been part of the magnificent 7 (group of companies that carried the US economy in 2023), however, they are the weakest performing company in 2024. There are macroeconomic conditions that need to be taken into consideration as well when making a judgment call about Tesla, such as the declining purchasing power of consumers.

Competitors are also getting better equipped to produce more cost-effective and higher-quality cars, which is pulling demand away from Tesla. There are valid concerns about the innovation at Tesla, with only the Cybertruck being the new model deployed in the last 5 years. Furthermore, the Cybertruck's development has been marked by delays and manufacturing challenges. However, one thing to remember is that Tesla has always had a cloud of insecurity by institutional investors but always seems to pull through and Musk’s personality is also one of a person that performs best when doubted - which is why I’m still bullish about Tesla turning the corner sooner rather than later.

Legitimacy of DJT

Trump Media & Technology Group’s(DJT) stock has been down 32% in the last week with Democratic groups urging Congress to investigate following revelations that the company relied on emergency loans in 2022, some of which were linked to a Russian-American businessman under federal criminal investigation.

The loans were utilized to facilitate DJT’s stock market debut through its merger with Digital World Acquisition, potentially earning Trump billions. Concerns over the loans stem from their association with a shell company tied to the Russian-American businessman and questions about potential quid pro quo arrangements. While there's no indication that Trump Media was aware of the nature of the loans, the merger has drawn scrutiny due to Trump's substantial stake in the company and its potential impact on his net worth. Additionally, the involvement of individuals like Michael Shvartsman, who pleaded guilty to securities fraud related to the merger, further complicates the situation. Democratic activists see this as an opportunity to challenge Trump's business dealings amid ongoing scrutiny over President Biden's son, Hunter Biden, and his business activities.2

The timing of the SPAC is not purely coincidental as mentioned in last week’s article as the funds from the IPO allow Trump to pay for his legal battles. The more information that is getting uncovered furthers the point that this company has very little underlying value but was potentially fueled by corrupt practices and/or Trump’s brand value.

Obsessing

What is a SPAC?

SPACs, or special purpose acquisition companies, were very popular a few years ago, the trend seems to have slowed but Trump’s media company is a recent example of a company using a SPAC to go public.

Instead of the traditional IPO route, SPACs raise capital through an IPO with the intention of acquiring an existing company. This process allows companies to access capital and potentially reduce transaction fees and time to market. However, merging with a SPAC presents challenges, including meeting accelerated public company readiness timelines and navigating complex accounting and reporting requirements. Target companies must be prepared to operate as a public entity within a few months of signing a letter of intent.

SPACs had a rocky start in the 1980s, plagued by fraud and lacking regulation. However, Congress intervened, imposing rules to safeguard investors' interests, leading to the rebranding of blank-check corporations as SPACs. Despite early challenges, SPACs gained traction over the years, attracting boutique legal firms and investors interested in distressed companies. The landscape changed in 2020, with more serious investors launching SPACs due to factors like excess cash and a surge in start-ups seeking capital. Today, SPAC sponsors are more reputable, focusing on disruptive companies in consumer, technology, and biotech sectors. While some question the sustainability of SPACs, recent studies suggest improved performance and investor confidence.

How it’s funded and structured:

SPAC is formed by an experienced management team with nominal invested capital, around 20% of the SPAC's interest (known as founder shares). The remaining 80% interest is held by public shareholders through units offered in the SPAC's IPO. Each unit includes a share of common stock and a fraction of a warrant. Founder shares and public shares typically have similar voting rights, except founder shares usually have the sole right to elect SPAC directors.3

Why might companies choose a SPAC over a traditional IPO

Speed and cost: SPACs offer a quicker and potentially less costly route to accessing public markets compared to the time-intensive and expensive IPO process.

Flexibility: SPACs can be a viable option for highly leveraged companies that may struggle to raise funds through an IPO due to their debt levels.

Shareholder benefits: In a SPAC merger, founders and major shareholders can sell a higher percentage of their ownership and avoid lock-up periods associated with IPOs.

What Should Investors know before Investing in SPACs

Investors may find SPACs attractive for several reasons:

Opportunity to invest in a private company that will go public through the SPAC, with the potential to buy more shares post-merger.

Returns are based on the appreciation or depreciation of SPAC shares.

However, there are significant risks associated with SPAC investments:

Limited financial reporting requirements may result in less information available to investors.

Investor ownership may be diluted by subsequent fundraising efforts or if other investors exercise their warrants.

Cash invested in SPACs may be locked up for up to 24 months.

Post-merger share prices may decrease, potentially leading to costs for investors.

SPACs near the end of their timeframe to acquire a company may face negotiation challenges, as targets may have enhanced leverage.

Terms of securities issued to sponsors may differ from those issued to public shareholders, giving sponsors substantial control over the SPAC4.

Learning

Stop Drinking From Plastic Bottles!

A study published in the New England Journal of Medicine suggests that tiny particles of plastic found in artery-clogging plaques may significantly increase the risk of heart attack, stroke, or death. Researchers discovered a fourfold increase in cardiovascular disease risk associated with the presence of these microplastics in the arteries of patients. While the study adds to growing concerns about the health effects of plastic pollution, experts caution that more research is needed to determine the exact impact of these particles on human health. Nevertheless, the findings underscore the importance of reducing plastic use to mitigate potential health risks and environmental damage.5