Reading

Chocolate is getting more expensive

The price of cocoa beans has skyrocketed in recent months, more than doubling since January and reaching record highs in March. This surge is primarily driven by a severe supply crunch, with the cocoa market facing deficits for the third consecutive year.

Factors contributing to the shortage include adverse weather conditions in West Africa, where most of the world's cocoa is produced, such as excessive rain and drought leading to the spread of diseases and aging tree stock. The surge in cocoa prices has been exacerbated by financial market dynamics, including speculative trading in the futures market and margin calls forcing traders to close out positions, further driving up prices. As a result, consumers can expect more expensive chocolate and potentially smaller servings in the near future. While higher prices may benefit cocoa farmers in the long run, current government pricing policies in major producing countries like Ivory Coast and Ghana are preventing them from fully profiting from the price rally. In the longer term, supply is unlikely to recover rapidly, with expectations of continued deficits and challenges in increasing production due to factors like tree maturation time and environmental regulations.

The Magnificent Seven has become the Fab Four

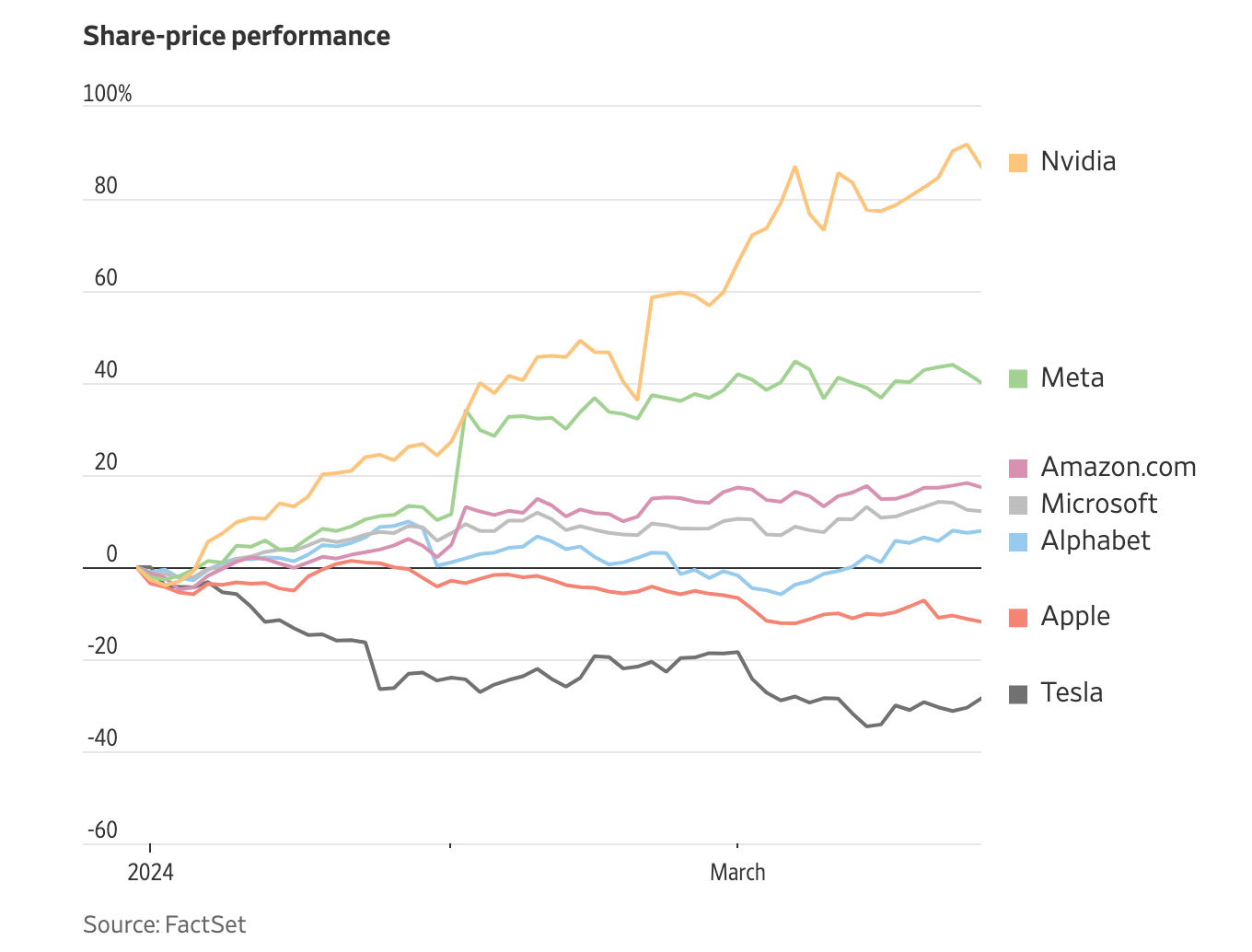

The stock market has seen a strong start to the year, with the S&P 500 rising 10% in the first quarter, despite notable declines in some major tech stocks like Apple and Tesla. However, other tech giants such as Nvidia, Meta Platforms, Microsoft, and Amazon have continued their upward trajectory, leading some to dub them the new "Fab Four." This divergence has raised questions about the sustainability of the rally, with some investors concerned about future gains. Nonetheless, hopes for economic recovery, anticipation of Federal Reserve rate cuts, and excitement over artificial intelligence have fueled optimism in the market.

While the Magnificent Seven tech stocks have driven much of the market's gains, there are signs of potential rotation into other sectors as the year progresses, as earnings expectations for the broader market are strong. Despite their recent gains, some of the tech stocks appear less expensive than they did last year, offering potential opportunities for investors. However, concerns remain about the challenges facing companies like Tesla and Apple, which have struggled with various issues including competition, regulatory scrutiny, and slower growth projections.

Obsessing

The Power of Branding within Public Companies

This week saw Donald Trump’s Media business which was launched as a SPAC go public. Trump Media & Technology Group (TMTG) saw a remarkable surge of up to 59% in its Nasdaq debut, reaching a market capitalization of over $10 billion. This surge was driven by support from Trump's followers, potentially providing him with substantial financial gains amidst legal battles. Despite reporting an operating loss of $10.6 million in the first nine months of 2023 on revenue of $3.4 million, TMTG's stock closed 16% higher at $57.99, valuing the company at nearly $8 billion. This stock rally where underlying earnings don’t seem to be aligned with standard KPIs has market experts questioning the legitimacy of the company’s valuation.

In this week’s ALL-IN podcast, Chamath Palihapitiya brought up an interesting point regarding how the business may be able to justify its valuation with the SEC. The discussion centers on TMTG and how it serves as an example of leveraging goodwill on a balance sheet. Chamath highlights how Trump's name, recognition, and likeness are viewed as assets with substantial value, similar to a trading card or a form of brand equity. This "goodwill" is perceived as a significant factor driving investment interest in the company, potentially inflating its market value beyond its fundamental business performance.

I researched further into how goodwill is utilized on balance sheets:

Goodwill encompasses intangible assets such as brand reputation, customer loyalty, and proprietary technology, which contribute to a company's competitive advantage.

Calculation of goodwill involves subtracting the fair market value of identifiable assets and liabilities from the purchase price of the target company.

Goodwill impairments occur when the market value of the asset drops below historical cost, leading to a decrease in the goodwill account on the balance sheet and a loss on the income statement.

Impairment tests involve evaluating future cash flows or analyzing similar assets and liabilities in the market to assess changes in goodwill value.

Goodwill is distinguished from other intangible assets by its indefinite life and the inability to be bought or sold independently

Bringing the above back to TMTG example, this approach implies that while traditional valuation metrics may not justify the company's current market value, the perceived value of Trump's brand and the support from his fan base create a unique dynamic inflating the value. There is also another market force at play called - Vote with the dollar, where investors pour cash into businesses that align with their ideology, artificially inflating the value.

Chamath warns of the potential risks associated with investing in such a company, cautioning against speculative behavior and emphasizing the importance of understanding the underlying fundamentals versus the speculative nature of the investment.

Overall, the discussion offers insights into how the concept of goodwill, particularly in the context of personal branding, can impact the valuation and perception of a company on the balance sheet, and how this intersects with broader market trends and investor behavior.

Learning

Daylight Saving Time (DST) occurred on Sunday 31st March when the clocks skipped 1 am. The history of the enacting of DST is:

British builder William Willett advocated for DST in 1907, envisioning longer daylight hours in summer to conserve fuel. The practice originated in 1916 during World War One to save fuel, specifically candles and coal. DST aims to maximize daylight utilization. During World War Two, an emergency British Double Summer Time (BDST) was implemented to address fuel shortages, with clocks set two hours ahead of GMT until the end of summer 1945, and again in the summer of 1947 following a harsh winter in 1946.